Robotics in Fintech: Downsides of AI in Finance

According to John McCarthy, the father of AI, “artificial intelligence is the science and engineering of manufacturing intelligent machines, in particular, intelligent computer programs”.

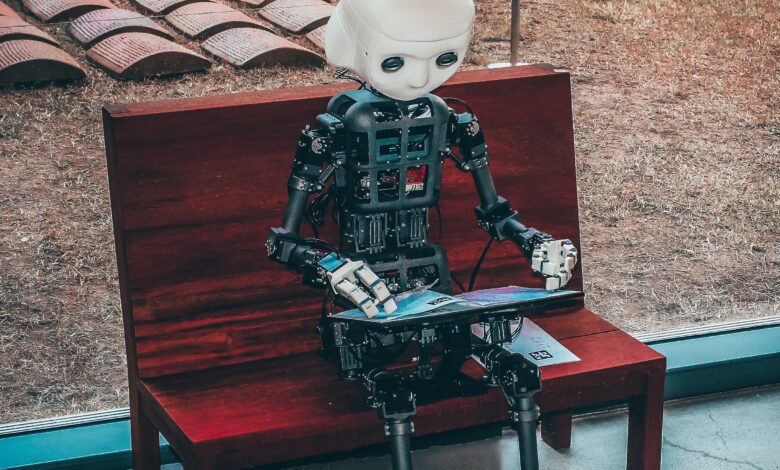

AI has to do with the making of machines that have the ability to think. AI is an important part of the present world. Its development and creation were done with the intent of having machines that are similar to humans in learning, thinking, and behavior but better in terms of output and productivity.

Applications

AI has been applied to the majority of the world’s present activities if not all. From games to drones to robots and mobile phones. In fintech, algorithms, ATMs, and chatbots are all visible applications of AI.

It’s no news that AI has been of great help to fintech in terms of:

1. Reduced human labor.

2. Reduction in man-made errors and mistakes.

3. Repetition of monotonous activities, etc

But is AI really a wise choice for the future of fintech? Here’s a list of the downsides of AI in Fintech.

1. Expensive

AI creation demands a lot of money. Their manufacture, maintenance, and repair are very expensive. They have software that needs to be updated and upgraded frequently as well.

2. Unemployment

This is the worst downside of AI in fintech. As a result of the development of AI, human labor in fintech would become less and less needed. This would lead to a jump in the unemployment rate and a rise in crime rates. Humans would, as a result, become lazy and there would be excessive dependence on the use of AI and machines.

Bankers would be sacked in order to make room for virtual banking assistants and robot bankers.

3. Inadequate decisions

Algorithms can misinterpret data and can also evolve badly. Trained on data specific to a given economic cycle, they may not anticipate radical changes. For example, in the event of an abnormal situation, such as a crisis, artificial intelligence can aggravate the problems because it has been trained on cumulative data in a situation. normal.

Errors can, moreover, go unnoticed because of the “black box” effect, i.e the lack of explainability. Artificial intelligence can cause discrimination without the actors who use it realizing it because we do not always know how it works.

4. Cybersecurity

According to a recent study by Deloitte, 40% of institutions in the finance and insurance sector say they have experienced a cyberattack via AI. This is to say if the subject is important. In its discussion paper, the ACPR notes that cybersecurity risks are accentuated in particular because of the massive use of data and intensive use of algorithms. This governance, to be effective, must integrate different departments.

5. Lack of creativity

Another downside of AI in fintech is that it isn’t creative. It can’t think or feel like humans. It chats about dream or imagines or come up with ideas. Obviously, even if Robo-advisors are more and more sophisticated, they will not replace human relationships. However the banks want to be reassuring on this subject, if artificial intelligence will come as reinforcement to assist, advise, and replace the real advisor for administrative work and certain analyzes, there will always be a real person with whom to dialogue and who will supervise your files.

Although equipped with increasingly precise analysis and management tools, Artificial Intelligence will not be able to predict the collapse or, on the contrary, the sudden increase in a company’s shares on the stock market due to an external event; just like a wealth manager or an ordinary financial advisor; the error is ultimately not just human.

Conclusion

There’s no denying that AI is beneficial to the finance and banking industry. However, there are risks and limitations that raise concerns about whether this technology should be incorporated into the sector. These downsides of AI are enough to make one worried about the future of fintech as a whole.

From employees to customers, AI relates to everyone on a daily basis. We can only hope that these downsides of AI in fintech are rectified as soon as possible to a minimal level so that the future of fintech can be safe and still belong to us humans.